8 Things I Did Before My Solo Travel Trip To Save $40,000

In 2019 I went off on a 297-day solo adventure. It inspired me to make ultimate guides on free travel strategies and more. And even though I’ve given away a lot of tips — I haven’t shared my experience with the money side.

It’s how I could afford to travel for 297 days.

Holy crap! Dude, $40,000 is not “traveling on a budget.” — a dear friend.

The funny thing is that I didn’t even spend half, and I tried.

And here are some other comments:

“There’s no way I can save that much for travel.”

“If I had that much, I could get x, y, or z, instead.”

Let me tell you where I’m coming from, who this is for, and why it isn’t all made up.

But before that, this is the first part of my solo traveling on a budget series.

- Saving money before the trip.

- Saving money during the trip.

- Getting back to everyday life after the trip.

In 2019 I went off on a 297-day solo adventure. It inspired me to make ultimate guides on free travel strategies and more. And even though I’ve given away a lot of tips — I haven’t shared my experience with the money side.

The most common question I get: “How did you afford it?

Mostly asked by friends my age, 20 to 30. And the thing that gets me giddy is that they have similar lifestyles to me — meaning they, or you, could do exactly the same thing.

They have a salary between 40k to 100k AUD (29k to 72k USD). They’re young, ambitious, and teeming with life goals, and they want to travel. That’s the person that this article is for. So if that’s you, welcome to the front row seat of how I executed my long-term travels.

Commitment

Before saving a crazy amount of money, I was dealing with a wave of uncertainty about the future.

Thoughts like whether or not I should spend the money on travel and anxieties about the impact on my career were creeping up on me.

- There was going to be a “gap” in my resume.

- There were more “responsible” things to invest the money in.

- I was going to put my life “on hold.”

These were the shitty thoughts going through my head, and if you’ve got goals, especially career-wise, you probably have some similar ideas.

But here’s the thing.

As further back as I can remember, I wanted to travel. No biggie, right? Everyone and their dog will put “travel” as an interest on anything they can. From Instagram to Tinder, you’ll see it plastered in bio’s along with “Food” and “Fitness.”

I was right there too, but I didn’t want it to be text anymore; I needed to take the plunge.

- Traveling turned out to be a part of my resume, not a gap.

- Traveling was an investment, probably the greatest one I’ve made.

- Traveling didn’t put my life “on hold,” it made me live it.

After you have the confidence to say, “I’m going to be fine,” you can start saving.

1. I Prioritized The Goal

The problem for me, and probably for you, was the money aspect.

- Making money.

- Saving money.

- And prioritizing those savings.

A fact: There’s always something else you can spend your money on. Big offenders are eating out, clothes, gadgets, etc.

If you get those out of the way and start saving, the problem becomes your options because they expand. You can suddenly afford to get a new car, the latest MacBook, that dress, or that suit.

Or if you’re more the adult-ing, responsible, considering-the-future type, you might think, “Well, the goal was to go on a long term trip, but I could wait, buy a house, pay it off, then try to do this later.”

And that’s your prerogative, it’s a lot of money — but that wasn’t the goal.

There was a reason you decided to save, and that was to go traveling. You obviously valued that investment over a house. So what’s changed?

If you want to create a big safety net, tick off those bucket list items, and have the solo travel experience, you need to resist the temptation.

- You’ll always have time to owe money to the bank.

- And investment opportunities making you more money won’t disappear.

Traveling, although still excellent, isn’t the same in your 50s.

Top Priority: Your future adventure.

Get that right, and you’re halfway there.

2. I Got Rid of The Impulse Buying ($9600 Saved)

Yeah, yeah. We’ve all heard this one. Don’t eat out often, don’t spend your money on useless crap yada yada — we all know this, but we do it anyway.

The thing that helped me here is something you might not have considered.

Start a Strict Workout and Diet Routine.

How in the shit is that relevant, right? You might see where this is going, or you might be surprised.

My biggest offenders were eating out and going out.

“I like eating, and I like beer, sue me.” — Me, circa 2017

But committing to my solo trip as early as January 2017 accidentally came together with another goal I had — wanting to get in shape. This coincidence saved me thousands.

You can’t outwork a crappy diet, and even nice restaurants cover their food in butter.

- I opted to cook my own food for the love of it and to control my calorie intake.

- I stopped drinking too much to increase my gym performance.

- I changed my impulse/lazy food habits to “once in a while for a treat.”

I went from 3–4 meals out per week to just one. I went from a night out every week to once in a while. I went from drinking mid-week to drinking on occasion.

This wasn’t perfect, I’m sure I slipped up, but this saved me approximately $9600 over the two years before my trip.

3. I Didn’t Own a Car ($9,200 Saved)

You either just thought, “Duh.” or “There’s absolutely no way that this applies to me; I need it.” And look, in a lot of cases, it’s non-negotiable for people, but in my case, I made it work just fine.

Let’s do some Aussie maths, you can do your own, but this is what it looked like for me.

- The average car insurance in Australia, which is compulsory by the way, is $1,131.

- Registration for a year in my state is $939.60

- Average petrol consumption a month is $161

- Parking in the city at my work was $50 a week.

I’m not even going to add in how much a car costs, or the servicing fees. But even without including the extras, owning a car and using it as my peers would have cost me $12,800 over two years.

Instead, I used public transport at $17 a week. Uber maybe once a week at $14. Big train trips every 3–4 weeks at $26 return.

This ended up costing $3,600 over two years.

- I walked and cycled places.

- I moved closer to public transport and urban hotspots — this doesn’t need to be expensive (I’ll explain soon).

And boom, an extra $9,200.

4. I Avoided Lifestyle Creep ($4,680+ Saved)

“Lifestyle creep refers to the phenomenon where discretionary consumption increases on non-essential items as the standard of living improves.” — Investopedia.

Or, in my words, “big money makes me spend more.”

Just like the car we were talking about, there are very few actual “necessities” — these are just luxuries in disguise, and you’ve heard that line, so you know.

I’m a fiend for a micro-brewed stout, a fresh haircut, and some quality sushi, but they’re all extras built on top of my poor university student lifestyle. I don’t need them; I just added them as my pay increased.

I didn’t get those luxuries when I was making nothing, and depending on how quickly your lifestyle creeps up on you, you end up saving fewer and fewer dollars.

How did I avoid this?

- I capped my rent to a maximum of $50 a week over what I was spending during university.

- I didn’t buy a new version of whatever item I had until it broke, e.g., phone, mattress, wardrobe.

- I still stuck to my bargain hunting guns, whether that was groceries or gadgets — if it’s not on sale, nope.

And look, when you start your job right out of college, don’t be afraid to treat yourself, but setting some rules will help.

I limited my extra lifestyle boosts to three relatively small things. For me, it was paying extra for good haircuts and a lovely meal now and then. But besides that, you have to stop the creep from creepin’.

A reliable example I can use was avoiding a $220/week apartment and paying $175/week for a cheaper one. — $45 a week in savings because I didn’t upgrade my lifestyle. That’s a deal.

Quick tips:

- Get at least two housemates.

- Opt for the smallest room and pay less for it.

5. I Minimized My Tax Obligation

If you’re reading this when you don’t have money, these aren’t going to be lifechanging tips. But when you start making money, it’s the difference between three extra months of travel and not going at all.

Fringe Benefits ($5525+ Saved)

These are benefits that your employer offers you other than money, like holidays, dinners, gym membership. Some of these are taxable; others are exempt.

Exempt means you don’t get taxed on those expenses — cha-ching. 💸

Work with your employer to package your salary so that they pay for certain exempt fringe benefits that you were going to spend money on anyway.

Example:

Say your salary is $60,000, but you go to the gym and eat out every week, which costs you $2,000. That’s money you’re going to spend anyway.

But if it turns out that meals and the gym are exempt in your tax code, you can get your employer to pay for them while paying you a $58,000 salary instead.

So effectively, you still get $60,000, but you only get taxed on $58,000. In Australia, I’d pay $11,047 on 60K but only $10,397 on 58K.

That means I just got a free $650.

In my case, working for an NFP in 2018, I could get up to $17,000 in exempt fringe benefits, effectively saving around $5525.

Looking into it and talking with your work is a great way to sort this out — it’s a win for them too.

Claiming Expenses ($600+ Saved)

There’s a crazy amount of items you can claim depending on where you live and what you do. In my case, I could claim either whole or portions of;

- Floor space in my house.

- Internet, phone, and electricity bills.

- My phone, laptop, and office supplies.

Google is your friend here.

6. I Didn’t Take Any Paid Leave in 2018 ($4,934 Saved)

Classic delayed gratification, but this time there’s a real dollar value on it.

In 2018 I didn’t take days off. It was tempting, but I knew that any leave I wouldn’t take would be money for my solo adventure. So that’s exactly what I did, but the key difference to my situation and maybe not yours was that I quit my job.

You, on the other hand, might not be doing that. So for your long term solo trip, you should try negotiating unpaid time on top of your paid leave so you can:

- Get paid for a portion of your trip.

- Extend your trip so you can travel for longer.

And if you’re considering quitting. Here’s some reassurance — it’s not the end of the world. Especially if you’ve got a year or two of experience, you’ll always return to opportunities. In fact, you might find some while you’re abroad.

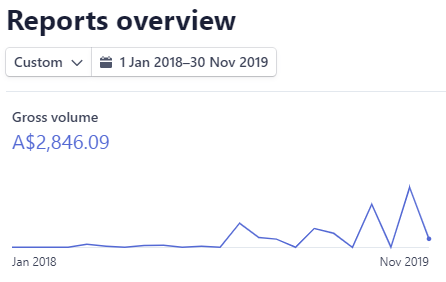

7. Get Your Side Hustle On ($2,846 Saved)

I was working as an analyst and an all-round web guy. Meaning there were tons of individuals, small businesses, and companies that would have some use for my skills.

But I sucked at it.

After doing it all day at work, I didn’t feel like doing more of the same for some extra cash — so I tried monetizing my hobbies instead.

I wrote a few relatively successful articles in 2018 that started circulating and ranking on Google during my trip.

I’d get little payouts that would go a long way every month — either paying for flights, accommodation, or food.

$200 could legitimately pay for a month of accommodation in some Southeast Asian countries — more on this in Part 2.

These savings were from efforts I put in the year before, and they paid off during the journey.

8. I Did a Fear Setting Exercise

“Fear setting? I thought this was about money?” — you.

And it is because here’s the thing, a lot of the fears with travel, at least for me, included money-related worries.

Fear setting is where you list fears for a big decision, and you write down how you would deal with it if it happened, or more importantly, things you could do prevent a situation from happening.

Here were some of my fears with money:

- Losing all my stuff and being penniless.

- Incurring massive fees for converting or accessing money.

- Needing to get back home as an emergency and not having enough.

- Coming back home and not having enough to last six months.

No matter how tiny or unlikely, I wrote them all down.

Writing down those little fears gave me focus and clarity on how to overcome them, and a lot of it involved a simple hack — throw money at it.

I made pots and set aside money for each fear.

- I got comprehensive travel insurance.

- I found travel cards that passed on the same exchange rates that Mastercard had.

- I set separate savings for an emergency flight back home, and a stash for when I was back and looking for jobs.

Treating these like separate additions to my travel costs let me have the confidence to pull the trigger on the adventure, and hey, it padded those savings to $40,000.

Quick Tips: Pre-travel checklist and how to manage money while traveling.

But the fears extended beyond money. The exercise let me confront other realities that might hit me like loneliness and career impact. It let me put systems and buffers in place, so taking the leap wasn’t a pain.

The Next Step

Saving money for the trip was one thing. It became a part of my lifestyle, and that was it — easy.

The real challenge was the unknown, the things I learned, and did on my trip — this was the good stuff.

- Traveling carry-on only.

- Staying in hostels.

- Taking jobs abroad.

- Picking where to travel.

- Hacking flight pricing systems.

- Understanding seasonal pricing for countries.

All of these and more came together to save me thousands while traveling, to the point where if I wanted, I could have traveled for multiples longer than I did.

I’ll be releasing Part 2 and Part 3 so stay tuned.

As for this one, I’m hoping you’ve got a few more ideas on how to save and a little more confidence about committing to the decision and pursing travel.

Good luck,

— Sah