How To Manage Money, Currency Exchange, and Travel Cards When Traveling

How to manage money, exchange currency, avoid ATM & Account fees, secure your accounts, and find the best travel cards while traveling. Pros, cons and tips - Ultimate guide.

On the long checklist before taking off on your travels, managing your money is probably up there with the other high ticket items. When traveling you want to make sure that;

- You have 24/7 access to your money

- Your money is secure

- You don't have to pay unnecessary fees

- You have backup options

- Your budget is well thought out

- You can track money coming in and out

And a whole lot more. We're going to break down the best options for carrying money while traveling, the best rates you'll get for money exchange, the best travel cards out there, and how to handle all your financials while traveling.

If you're lost in a seas of options keep reading.

Table of Contents

- Carrying Cash

1.1. The Perks

1.2. The Downsides

1.3. What currency should I carry?

1.4. When should I convert?

1.5. Where can I get the best exchange rate?

1.6. How much should I carry?

1.7. How do I secure my cash? - Travel Cards

2.1. The Perks

2.2. The Downsides

2.3. What to look for in a good travel card?

2.4. Australia Travel Card Options

2.5. Canada Travel Card Options

2.6. UK Travel Card Options

2.7. US Travel Card Options

2.8. How do I secure my travel card? - Dealing With Foreign ATMs

- Travel Budgeting Tips

4.1. How do I calculate my travel budget?

4.2. How do I track my spending? - Pre-travel Financial Checklist

5.1. Inform your bank

5.2. Backup Cards & Precautions

5.3. Take some local cash

Carrying Cash

The Perks

Carrying cash on your person is old fashioned but still one of the best ways to travel. Many countries across Europe, Asia, and the Americas still use cash as the predominant way to engage in the market.

- You don't pay ATM or Account fees

- The currency conversion will be some of the best rates you'll get

- You're fully in control of you money, there isn't a middleman holding it

The Downsides

Carrying large quantities of cash comes with it's downsides as well. Many people will think of security risks involved. What if it get's stolen? What if I lose it? - These questions will play in your head. But the likelihood is quite low, and with precautions, it's next to nil - but the thought and risk is still there.

We'll talk more about security and precautions in the sections below.

What currency should I carry?

If you're from a first world economy, you'll find that your currency will be accepted in most countries for conversion to their local currency. However, no matter where you're from, having US Dollars on you is by far the best option.

- It's accepted everywhere for conversion into a foreign currency.

- The exchange rate is more or less consistent, and better than other currencies in many cases - except for the Euro in Europe.

- Currently, it's the defacto world currency.

As an Australian for instance, I'd still carry US Dollars if I was going with a cash option.

When should I convert?

It's always a good idea to convert a portion of money to the local currency before you land in the country. But keeping the bulk of it in your own currency will allow you to convert as you need to, rather than potentially having excess of the local currency when you leave.

Where can I get the best exchange rate?

There will be multiple currency exchange booths at your destination, both at the airport, inner city, tourism hot spots, banks, and more local hubs - You can get good rates at all of these places, but there's still potential to get bad rates as well.

- If it's a large airport with multiple different companies operating booths, you could find a good deal right at the airport.

- Inner city exchanges are easy to find but vary in their rates, some being higher than others, but all being slightly inflated - same goes for tourism hot spots.

- Local hubs, and surrounding suburbs/districts are your best bet to find the very best rates.

- You can also go to a national bank that will convert it for you, check the rate but in a lot of cases, especially for USD, EUR, GBP - the rates are good.

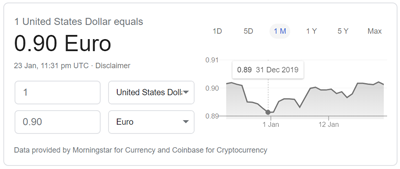

Hot Tip #1: Always check the real-time value, and month average of a currency before converting - a simple Google search gives you this natively on Google

Hot Tip #2: Bargaining is very much an option for a lot of places in the world, even when it comes to money exchange, and especially if there are multiple booths.

Hot Tip #3: TripAdvisor and Google Maps are your best friends here when it comes to reviews of currency exchanges. When you find one, have a look at the rates they're charging but also look at the reviews.

How much should I carry?

This very much depends on your budget, whether you're taking cash as your only method of payment, and how long you're going traveling for.

But in any case, regardless of whether you're opting to carry mostly cash or a card - you should have $200 in US currency on you, as a lot of the time, especially in Asian countries; visa fees, entry fees, extra baggage fees, are either collected in USD or the local currency - you never know when the cash may come in handy.

How do I secure my cash?

The risks involved with carrying cash, although very small, are very vivid. We can all imagine losing the money and being stuck somewhere - all because we opted to carry cash. But it's much more secure than you think - here are a few ways to secure your cash.

- Travel money wallet - Physically speaking, this is a fantastic way to keep your money strapped to you, secure, and out of site. Here's an Amazon link: https://amzn.to/2RsTO4y

- Lock for your bag - Any lock that you can put on a locker in your hostel or on your bag, is a good enough measure to keep your belongings safe. Make sure to get a bag with hard lockable zips - Like the Osprey Farpoint 40.

- Travel insurance - Your travel insurance will most likely cover lost or stolen cash, though not a crazy amount - in most cases it's only up to $250.

- Split it up - In the event that your bags got broken into, it would be risk mitigation to have certain compartments, short pockets, and other, with portions of your money split up - some of it on you as well.

Travel Money Cards

The Perks

Travel money cards are one of the default ways to access your money while traveling these days. They come in dedicated cards specifically for travel, or travel account options from your bank. And they have many perks;

- Allow you to load up different currencies

- Instant access to your account and balances

- Convert as needed

- Keep your money secure

- Not have to carry cash everywhere

The Downsides

With a lot of perks comes a few problems with having travel cards. There's a host of fees that you need to watch out for, and the conversion rates can take a huge chunk out of your saving too - all of these are potentials and don't apply to every card.

- Reload fees

- Currency conversion fees

- Bad conversion rates

- Account fees

- ATM fees

Note that there are a lot of cards that are quite good, you just need to find them - we have suggestions below for the US, Canada, UK, and Australia.

What to look for in a good Travel Card?

A lot of the downsides to having a travel card can be mitigated with some good research and testimonials from people that have already used them. When getting one you should make sure it has:

- Default or better MasterCard/Visa rates for currency conversion - with no fees

- No reload, transfer, or account fees

- Rebates on foreign ATM fees

- Easy options to lock your cards

- Come with a backup card

Most competitive cards these days will have a combination of these, with the best having all of them with specific requirements like a monthly deposit exceeding x or y. Make sure you check the terms and conditions, and the rules associated with the card.

Hot Tip #1: Make sure you know whether the travel card is a credit or debit card - some travel cards are also credit cards which will have terms attached to them like paying a bill within 55 days or incurring a huge interest rate - make sure you check if this is the case.

Note: We're not affiliated with any of the cards in the next few sections, please do your own research when getting one.

Australia Travel Card Options

Most cards available for Aussie travelers waive fees on reloading funds and converting currency, though they still have ATM fees that the issuing bank will charge you, on top of what the foreign bank still charges you.

They also use multiple different methods for determining the value of currency where they'll cut into the conversion rate and make money there on every conversion. So on paper you have no fees, but in reality the conversion rate is the fee. So you need to really compare the best options.

This card is one of the best for Aussie's but it comes with a few rules. To unlock these benefits, you need to deposit at least $1000 a month into the account, and make 5 purchases using the account. This is OK if you've saved for travel and just move $1000 a month into the account while you're traveling.

- Uses the Visa Exchange rates without adding an additional fee

- Refunds all foreign ATM fees

- No account, reload, transfer, or conversion fees

There are many other travel cards offered by all the big banks, like Commbank, NAB, Westpac and ANZ - but they all have their pro's and cons. The best one we've found so far is the one from ING. Though others may come with free insurance and other perks.

Canada Travel Card Options

Canada, like the US is very heavily saturated with credit card options for travel; each offers points and other benefits though at a cost usually in the form of an annual subscription. That being said, there's one fin-tech startup that allows re-loadable fee free transactions - perfect for traveling.

- No account fees

- No transaction or conversion fees

- No ATM fees, but doesn't rebate the foreign ATM's own fees

- No markup on base Mastercard Exchange rate

We don't have anything bad to say about this card, they're doing everything right. It seems like a no-brainer with this one. However, if you are looking for a point based system, this isn't for you as even though it has rewards, it's not a credit card.

UK Travel Card Options

There are a lot of fin-tech startups disrupting the banking sector in the UK. This means some good deals if you're a UK citizen and you want a travel card. A lot of the travel cards won't have fees attached to them, but with some rules.

Specifically very good for use within Europe as there are no ATM fees charged by Monzo in this region, and the card is directly linked to your account, so there's no associated fees like reloading.

- Uses the Mastercard's exchange rates without fees on top

- Free ATM withdrawals from within the Europe Economic Area so any country within Europe as a baseline

- ATM withdrawals outside of the EU are free up until £200 a month, it's then 3% for any withdrawal over.

- No Fees on spending with your card

The downside, as you can see, is a hefty 3% fee on anything you get out over £200. This may not be a problem if you're traveling South East Asia on a budget, and it's not a problem for Europe (No Fees) but if you're going to the US, Canada or Australia, you'll rack up some expenses fast.

The good news is, those countries are heavily based on using your card, especially with Australia being almost all contactless in 2020 - so you're safe with those withdrawal fees.

If you're concerned, you can always have multiple cards as a lot of services offer a similar model. So you can split up the cash withdrawal.

Revolut for instance marks up currencies on the weekends by 0.5% - but uses the default rates during the week. Yes not as appealing, but it also let's you withdraw £200 a month from ATM's without a fee. Having both Monzo and Revolut would allow you to get up to £400 a month of your money in cash if you needed it.

US Travel Card Options

The US has countless credit and debit travel card options with varying rules, benefits and detriments depending on which one you get. But with all this competition, there's some that are extra competitive, those are the ones we want.

Schwab Bank High Yield Investor Checking® account

Schwab has one of the most attractive account options for travel with a lot of the perks we're looking out for - which makes it a good option to consider if you're from the US.

- No foreign transaction fees

- ATM fee rebates

- No monthly account fees

- Yields interest of 0.15% annually

But beware - It took a lot of digging to find out what currency conversion rates this account uses, and it's buried in the fine print - it uses the default Visa rates but ambiguously says (bottom of section 5) the rates are determined by Visa, plus or minus adjustments made by [Schwab Bank] - you can put your money on it that it's going to be an addition of fees in most cases. Summary here.

So definitely check the rate you're getting before withdrawing money - it's still a good account and a good deal, just to exercise caution.

Note: A lot of US Banks operate credit cards with a point system for travel, and that's what the market usually goes for. It may be worth checking out these cards as there's potential that the benefits with points/miles and free travel insurance outweigh the less favorable fees - look at credit card ratings/reviews for these.

Dealing With Foreign ATM's

Chances are you're going to need to use an ATM on your trip. Depending on the card that you have, you'll have different experiences in terms of fees. But regardless of fees, there are a few things to watch out for.

A foreign ATM will ask you if you want to withdraw in the local currency or convert from your own currency, that could be USD, CAD, GBP etc. ALWAYS and I mean always, pick the local currency. Otherwise your travel card will convert money from the local currency to your own and then back to the local currency, charging you two sets of fees.

The above is the most important tip to keep in mind, but there are several more to keep in mind below.

Top Tips:

- 💰 Always pick the local currency on an ATM if given the option.

- 💸 A national bank is almost always the best option to withdraw money without a foreign ATM fee, private ATM's like the predatory Euronet will charge you obscene fees to take money out.

- 🕵️♀️ Make sure you scan the surroundings of an ATM for potential scam or fraud machines installed - particularly the card reader area.

- 👑 Look up the company operating the ATM before using it, if there's not a lot of data on it, and it seems like a single one without a network - avoid using it. Any problems will be difficult to solve.

Travel Budgeting Information

How do I calculate my travel budget?

Your travel budget is quite simple to work out. Its your daily accommodation, food, and entertainment costs - multiplied by how many days you're abroad for, which gives you a daily budget.

You can include the fixed costs like flights and insurance in your daily budget as well. Just divide them by the amount of days you're gone, and spread it across your days to see how much your trip comes to per day overall.

[Days Abroad x (Daily Accommodation + Daily Food and Entertainment) + Flights + Insurance] / Days Abroad = Daily Spend

How do I track my spending?

You can use Excel or Google Sheets to create a spreadsheet of your entire budget per day if you wanted to - or if that sounds like the biggest drag in the world, you can just track how much you're spending per day in your notes app. But we can do even better.

There're 2 cool expense tracking apps out there that I can vouch for.

- Pocketbook - Links with your bank account and automatically documents what you're spending so you can categories them.

- Splitwise - An app for group expenses and tracking, great if you're going to be traveling with friends.

Pre-travel Financials Checklist

Inform your bank

A lot of the time, especially if you have a modern travel card, there shouldn't be any problems going abroad. However, if you're using your day to day card, there's a good chance that your bank will see the first time you use it abroad as a fraudulent expense and lock you out of your account.

When this happens, it's a long and painful process to get your account back, all the while you're not able to access your money.

Give the bank a call and let them know that your leaving and they'll make sure that your account doesn't get locked.

Backup Cards & Precautions

Speaking of painful situations, there's a chance that your card may get lost or stolen. In this case, you want to have a backup card. Not only a second card for your main travel account, but another travel card all together.

- Having multiple accounts makes sure that if one system is down, or you get locked out, you have another system to use.

- Keeping them in separate places decreases the likelihood that you'll lose all of them e.g. keep one on yourself, one in your main bag, one in your day pack.

- Make sure you know how to lock your cards before they gets lost, so you're not struggling to figure out how to lock them when you're in panic mode.

Take some local cash

Regardless of whether you're going the cash route, the card route, or a bit of both - you should always take a small amount of local cash with you. US Dollars can be another fail safe in case you need cash and can't use your card.

You can get this initial amount converted from your local currency exchanges or banks. Or again, you could just have some US Dollars on you, which should be easy to convert if you need to convert.

This article is being managed and updated frequently. More sections and tips to come as we get more questions. Hope this helped you out!

Happy traveling,

Sah